With online loans becoming mainstream, several small businesses now prefer them over traditional loans to meet their requirements faster and in a transparent manner.

Combined with online tools that accelerate the application process, an innovative way to evaluate the creditworthiness, and using high-end technological tools to determine eligibility, online lenders can approve business loans that have been overlooked by conventional lenders and process them in much lesser time as compared to their traditional counterparts.

Also Read: 5 Tips To Improve Your Odds Of Getting A Small Business Loan

Doing the right things can increase your loan eligibility with digital lenders There are several key factors that affect your business loan eligibility, and some of the most important ones are as below-

1. Keep Business Transactions Digital

Table of Contents

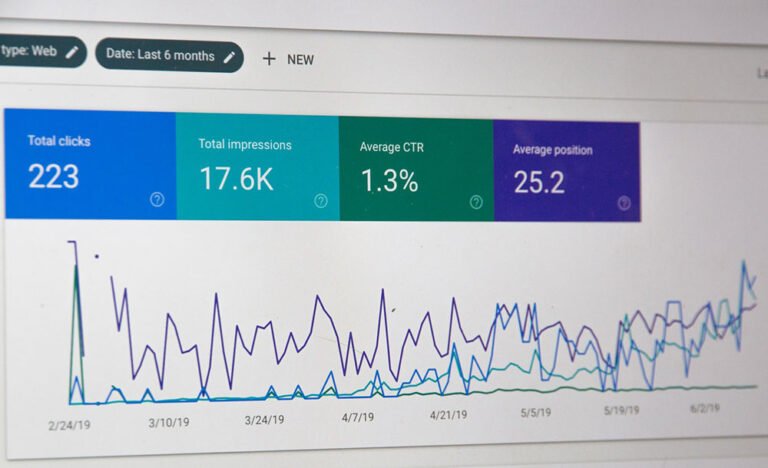

A large number of online lenders make use of advanced credit algorithms to evaluate your business. For instance, they might access your business cash flow, transactions and other digital data points to know your creditworthiness.

The use of advanced algorithms accelerates the process, allowing you to get loans faster than traditional lenders. Keep your business transactions digital by using card swipe machines, wallets or payment gateways as this will make it easier for the lenders to assess your creditworthiness.

2. Type of business you have

There are many things which can be used to differentiate a business from the other. A key factor for lenders is the risk level. Some trades are known to be riskier than the others, and lenders try to avoid lending money to businesses that are too risky.

If a lender believes that you are too risky to lend, they might approve the loan but at a higher interest rate. So, the type of business you have is an essential factor that affects your eligibility.

3. Your business plan

To get a business loan, you’ll surely need a robust, detailed, and comprehensive business plan. This is especially important for a new business. The business plan is your weapon to demonstrate what you plan to do with your business and what your future goals are.

The lenders might consider your business plan to decide whether or not they should grant you a loan.

4. Your business experience

Most of the lenders require your business to have an operational history of at least two years. However, there are some lenders that offer loans for start-ups too. In short, the longer the business experience, the higher are the chances of your loan getting approved.

Apart from this, if your business has been operational for a long time, it would be easier for you to negotiate the terms of your business loan.

Apply For Small Business Loans In India

5. Having the right documents

You’ll need documents to apply for a business loan. Fortunately, the process is now much easier than traditional lenders.

Some of the most important documents that you’ll need include- business registration proof, KYC documents, bank statement, PAN card and Aadhar card of the business promoter. Unavailability of these documents can affect your loan eligibility. An Aadhar card with the linked mobile number for OTP verification will help in speeding the process.

The online availability of businesses loans has helped small businesses as small businesses find it difficult to get loans approved from traditional lenders. If you are looking for a small business loan, remember the factors mentioned above as they significantly affect your loan eligibility.