If you think of any business, the first thing that comes into the mind is capital investment. Be it establishing small businesses or expanding the existing ones, we all look for easy credit loans. Some even try to hit upon financial aid as a solution to overcome existing losses.

It has been observed that there are different stages that define the credit requirement of any business. One must analyze the stage of their business – start-up, survival, growth or sustenance stage. The main issue is the long and postponed payment cycle that results in an urgency to raise money from different sources for business survival.

Also Read: Lines of credit: online lenders vs. traditional banks

Credit Sources for SMEs

Table of Contents

There are private as well as government organizations that extend help to small and medium businesses. Their credit loan policies and terms state pre-specifies loan credit for a certain period of time. It is a big help for SMEs that struggle to meet their day-to-day expenses.

Listed below are a few common sources that offer credit loans in no time with easy processes and minimal documentation:

Angel Investors

You can easily approach an angel investor who can finance your business in return of ownership equity or convertible debts. It is one of the most popular ways to raise money. These investors analyze the potential in your business and calculate the profit that it can fetch in the future. You must make sure the paperwork is solid and does not have any loopholes.

Also Read: Cash Crunch: 7 Tips To Avoid It

Bank Finances

Banks are the most famous source of credit loans for maximum businesses. They provide a certain amount for a defined period of time against the security of any asset such as land, house or even jewelry these days. It is just that getting a loan easily is a little complicated for the SMEs that do not have a good financial loan history. Therefore many SMEs deposit potentially long-term assets for short term credit loans.

Self, Friends and Family

What if your business is not doing well and thus loans are also not easily accessible. You will definitely turn to your own savings. In the worst case you will have to ask help from family and friends. You can think of it as a credit loan with zero interest rate.

Also Read: Change The Way You Think Of Debt

Venture Capitalists

If you want high-risk but at the same time high return investment, go for it. It is basically a subsidiary of companies that hold significant cash for investment purposes. To attract a venture capitalist to invest in your business, come up with a solid plan of action that promises higher returns. In most cases that is difficult. So the SMEs end up selling their business to venture capitalists rather than getting credit loans.

Stock Exchange Listing

If you list down your SME into the stock market, it will be considered as a quoted company. This will bring finances in the form of company shares. But the issue is that you must grow your business to a certain extent to get listed in the stock market. The majority of MSMEs don’t even consider it as an option. But you can if your business has potential.

Also Read: How To Immunize Yourself To Inflation

Leasing

Ever thought of leasing your assets like cars and even houses? Yes, it’s one way to raise money legally. Go to a leasing company or individual and get the amount you want by leasing your assets.

Also Read: Debt Or Equity: Find Out What’s Best For Financing A Company

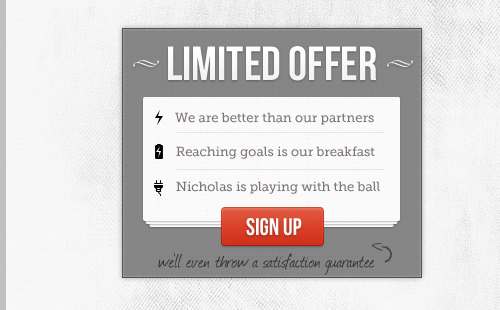

Indifi

It is an online platform that lends credit loans in an uncomplicated and quick manner. Indifi issues loans to customers without charging heavy interest and asking for any collateral. Its main aim is to solve the financial problems that MSMEs are facing these days. The processes are flexible and prompt. The platform is inclined towards the latest online techniques that establish a stage for those who do not have previous credit history and can’t avail of instant business loans.

Also Read: Cash Flow Management Tips For Seasonal Businesses To Remain Profitable Year Around

Doing business is not as easy as it seems. There is a lot of pressure to get the profit out of your investment and even raise money if need be. Being an SME is a challenge on its own. But you eventually grow with your business. And when you will look back to the hurdles you faced, you will realize how that has given you the experience and push to achieve your goals.

For other financial aids and simplified money borrowing experience, consult Indifi. It not only simplifies the entire process for credit loans but also helps you with easy documentation and quick approval of loans.