At its very basic, loans taken to either start or support a business are known as business loans. Just as in the other types of loans, you must repay the principal amount and the interest. There are different types of business loans that you can get, including bank loans, mezzanine loans, asset-based loans, and microloans.

But did you know that apart from these types of business loans, there is also something called a balance sheet loan? To understand the concept of balance sheet lending, you must first know what a balance sheet is and how it helps a company to understand and manage its finances better.

Also Read: Best Ways For Hiring People For Retail Shops

Balance Sheet

Table of Contents

A balance sheet is the front page of a company’s financial status. In that, it holds information about your company’s net worth, assets, and where you can find them.

Every company prepares three financial statements, including the income statement, cash flow statement, and balance sheet. Please think of the balance sheet as an overview of a business’s financials, such as its assets, liabilities, and equities.

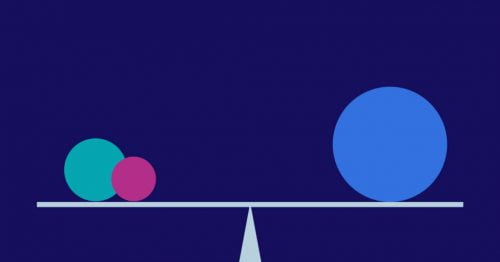

What this balance sheet helps the company do is that it gives vital financial information that you can use to estimate various ratios like the ‘debt to equity ratio,’ which is a company’s ability to pay off all its debts using its equities.

But that’s not all that balance sheets do. By looking at the balance sheet, a company can also know its financial stance at a particular time, starting from the first day that it started operations.

Also Read: Importance Of Accessibility In Getting Quick Business Loans

Balance Sheet Lending

Typically, there are different types of loans that you can borrow. And balance sheet loans are one of them. The significant difference between a balance sheet loan and other types of loans is that the original lender accounts for the debt in balance sheet lending. In other words, when you borrow a balance sheet loan, it is the lender who takes the risk of losing the money rather than the borrower.

Most balance sheet lenders are small banks and financial institutions or life insurance companies. And they usually process these loans at 65% of the total amount of money required for purchase. They do this as they have lesser capital to work with and use more conventional techniques to accept profits’ forecasts.

Also Read: Expect The Best With Effective Business Continuity Planning

Benefits of Balance Sheet Lending

One of the significant benefits of balance sheet lending is that it facilitates a seamless communication process between the borrower and the lender. In traditional lending, however, such a thing is not possible, as it is difficult to trace the loan. It’s because the money lent travels through different hands, most collection companies, who take their share. That sort of thing can also make it more expensive.

But in balance sheet lending, such things rarely happen since the debt is almost always with the original lender.

Another thing to note is that balance sheet loans are much easier to manage since the money always lies with the original lender and doesn’t go from one collection company to another. The reason is simple. When you borrow money from traditional lenders, that money travels from one collection company to the other.

And the rules of repayment may differ for each collector, making it harder for you to keep track of the loan. So, working with one lender would be much more comfortable than with multiple collectors or collection companies.

Also Read: All you need to know about business loans and taxes

Balance Sheet Lending and Business Loans

You can also borrow business loans from balance sheet lenders. When you approach a balance sheet lender and ask for a business loan, they generally look for these aspects.

General Aspects

Balance sheet lenders generally consider three general aspects of business loan requests: safety, the amount of money that they should lend along with the interest rates, and terms and conditions for the same.

So, when they look at the balance sheet of a company, they look for those aspects related to the other financial statements, and if there are any issues with them, they also think of ways to resolve those issues.

Assets and Liabilities

When balance sheet lenders look at the company’s assets, they primarily look for substantial cash and current accounts to help the company meet its debt repayment obligations. However, the lender may also look at the liquidity of those assets and the company’s overall ability to generate revenue in cash.

And when it comes to liabilities, lenders mostly look at the company’s short-term and long-term liabilities and their relation to the assets and funds. In looking at the company’s liabilities, a balance sheet lender also looks at whether the company already has debts to pay off and can take on additional debt.

To do this, a balance sheet lender uses two simple leverage ratios, including the debt and the debt-to-equity ratios. The debt ratio is the ratio of the total debt that the company must pay off to the total assets it has amassed. While the debt-to-equity ratio is the ratio of the total debt that the company must pay off to the equity of ownership.

Both these ratios serve as the basis for analyzing whether a borrower or company can pay off new loan debt.

Also Read: How to repay business loans? adopt these methods

Final Thoughts

So, balance sheet lenders look at various aspects of a company’s balance sheet to get an idea about its financial stance. They do so to know whether that company or borrower can pay off all the debts on the loan that they borrow from them.

Nevertheless, from a borrower’s perspective, there are various benefits of borrowing money from balance sheet lenders than other, traditional types of lenders. And the significant advantages come in the form of the ability to track down the money you borrow and the ease of managing the loans since there is only one lender.