The web has changed a ton about our reality, from how we associate with old companions to how we eat. Also, in the realm of business financing, the web has changed the number of entrepreneurs who get cash. Banks and other traditional credit providers aren’t your only financing choices any longer. A lot of elective banks, or online moneylenders, couldn’t imagine anything better than to loan to you as well. In any case, what makes them unique? What’s more, how would you know which one is better for you as a borrower?

Lending for small and medium enterprises has never before been so brimming with various alternatives as it is presently. For entrepreneurs, that is something to be thankful for. The hazardous development of the elective loaning industry has prompted more admittance to loans for entrepreneurs that the conventional banks have been dismissing, without a doubt. However, that is not in any way. Credit providers have pre-set advance breaking points that are offered by banks and other different elective moneylenders. This kind of credit is accessible for use whenever. With a credit extension or LOC, the borrower can “pull out” cash out until you get to as far as possible. The cut-off recharges as the cash is reimbursed, permitting you to get again varying. Alternative modes of money lending like online credit companies have additionally been improvising how those run of the mill advance items we’ve all been aware of and adored (or not) work. For instance, take your usual credit extension. Contingent upon whether you’re taking a gander at a credit extension from a conventional bank or any other digital lenders, you may be managing two pretty unmistakable advances.

Also Read: How to get a line of credit for a new business?

Comparing Traditional Sources of Lending and Online Modes of Credit:

Table of Contents

The main points of difference between the two modes of credits are:

Flexibility:

Nowadays, there is a major alternative source for loans that suits each kind of business. Perhaps the best favorable position of getting credit from these banks is adaptability. With credit extensions structure online sources, you can choose amongst various plans as per your monetary circumstance and ability to pay. You additionally don’t need to have an exceptionally high credit rating. Some online banks couldn’t care less if your credit rating is that terrible, as long as you can show a steady yearly income.

Also Read: 6 Smart Ways For Small Businesses To Use A Line Of Credit To Their Advantage

Eligibility Requirements:

As a rule, banks attempt to loan to more unsurprising entrepreneurs. They face fewer challenges, as per the analysis of the financial crisis of 2008, banks fixed their limitations much further—loaning to just the most traditionalist ventures. While they’ve loosened up a bit in the previous few years, more youthful or more modest organizations experience difficulty making their severe norms.

Online lenders like Indifi Technologies Pvt. Ltd. are more inclusive and effectively take into account the underserved entrepreneur. While new organizations, non-beneficial organizations, or proprietors with tested records may, in any case, discover some difficulty, a lot more entrepreneurs can discover an advance to assist their business with developing. This isn’t explicit to credit extensions; however, it’s as yet a significant distinction to remember.

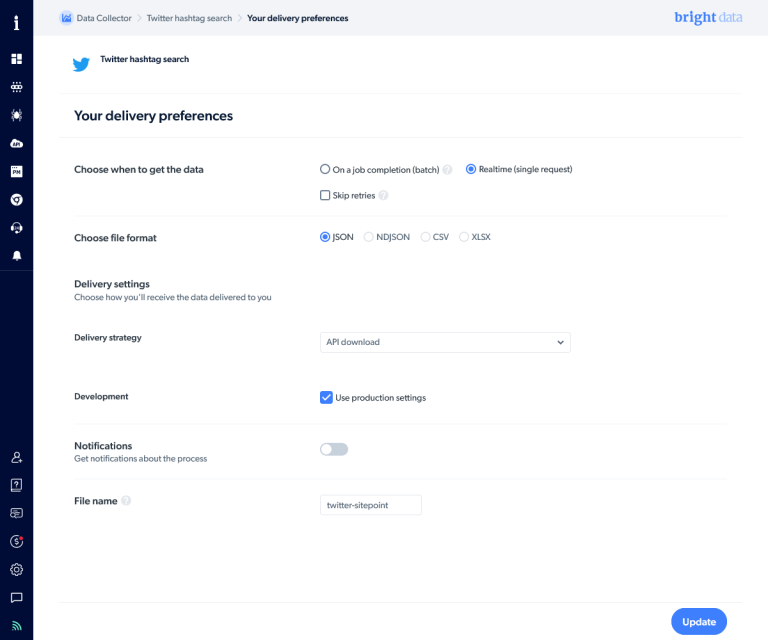

Application Process

Concerning the application process, online sources have a simpler and more user-friendly application set up. You can discover immediately if you are equipped for the advance or not, saving you a ton of time and permitting you to apply to another firm if you get dismissed. The endorsement is snappy, also, and once the application gets affirmed, you will see the cash in your record in a matter of seconds. These are a portion of the things that cause online moneylenders to appear to be welcoming, particularly to organizations and people that would prefer not to encounter the pressure associated with applying for a bank advance.

Also Read: Business Loans vs The Line Of Credit

Terms of the Credit Agreement

One small disadvantage of online sources of credit is that they charge interest a bit on the higher side as compared to banks. Banks have very low loan fees around; however, online moneylenders need to make up for their greater danger speculations and adaptability—and that remuneration appears as costlier money. Banks charge minimum processing fees and laser interests, while the interest rates for an alternate line of credit can be up to 8% to 24%, excluding processing fees, withdrawal expenses, or anything else that may add to a greater EMI.

Collateral Security

Both banks and alternative moneylenders offer unsecured and secured kinds of loans. Lenders apart from banks rely a lot on unsecured loans, but some of them ask for small collateral such as inventory, backup stock, etc., to have a small guarantee on the money lent. Yet, we should jump a piece into what precisely that implies. Loans that are not secured by collateral simply implies that a credit extension isn’t attached to a specific piece of guarantee. Unstable bank credit extensions will, in general, be a bank’s littlest offer—since, normally, it’s the most dangerous.

Banks additionally offer credit extensions made sure about by working assets and stock, land, or even fixed deposits—which is simply cash you can’t pull out and invest again for a while. Alternative lending options depend all the more vigorously on unstable advances; however, a few banks offer credit extensions upheld by stock, hardware, or even records receivable.

Conclusion:

Both online and traditional modes of credit are immensely popular amongst borrowers, especially small and medium enterprises. There are pros and cons of both sources depending upon the terms of the policy, flexibility, ease of application and approval process, or even the kind of collateral they ask. Interest rates and loan tenure are two major parameters to consider while choosing your line of credit. Under the circumstances that you are a private company that is working for over 3 years, has a decent credit standing and a consistent income, at that point, a bank advance is an incredible alternative. Since you have these characteristics, your advance is bound to get affirmed.

For some individuals, the adaptability, simplicity of use, and admittance to moment money that elective online loan specialists offer are very overpowering. Online banks are ideal for private companies and new businesses the same, and the individuals who need to approach subsidies that they can use to develop their business. Moreover, since they generally require no insurance, it very well may be very engaging. With both online moneylenders and banks having particular advantages and disadvantages, the choice regularly lies on the kind of business and the individual getting the advantage. Eventually, the choice is all yours. Thus, gauge the upsides and downsides, look at the alternatives, and pick the best offer that you can get.