MARCY, New York — From afar, the new Wolfspeed factory in upstate New York looks like any other large corporate office building, with an unassuming gray exterior and large glass windows. But hidden inside is a high-tech plant that’s almost entirely operated by a fleet of robots programmed to build semiconductors with a high level of precision. The scene is a far cry from the manual labor of the 20th-century Ford assembly line, and it just might be the future of American manufacturing, at least according to the politicians and executives who celebrated the plant’s grand opening in late April.

To mark the occasion, a few hundred people, including Wolfspeed employees, investors, and local officials, gathered in a large tent just a short walk away from the factory’s entryway. A series of speakers, including Wolfspeed CEO Gregg Lowe, took turns boasting about the plant’s importance — for local jobs, for technology, for fighting climate change, and even for American prosperity. Also in attendance was Eric Bach, the chief engineer of Lucid Motors, an electric automaker that, just a few hours earlier, announced it would start using Wolfspeed’s chips in its vehicles. The star of the show: New York Gov. Kathy Hochul, who claimed the new facility was part of the “greatest comeback in the history of this nation” before she took a spin in one of the luxury Lucid EVs.

“This has to happen. No longer can the country, the United States, be brought to its knees because of supply chain issues,” Hochul told Recode. “Make them here! Make them in New York! We’ll put the money behind it.”

Wolfspeed’s factory is opening its doors after more than two years of a worldwide semiconductor shortage that left cars without parts and the health care system low on medical devices. To produce more chips, the Biden administration, with the help of state governments, now plans to invest $52 billion in the chip industry to build more factories just like the new plant outside Utica, New York. The hope is that these plants won’t just make more semiconductors; they’ll spur a tech manufacturing renaissance in the same country that invented the computer chip and produced Silicon Valley decades ago.

This new crop of chip factories, sometimes called fabs, won’t be ready in time to solve the current chip shortage. These facilities will take years to build, and even when they’re completed, they won’t produce as many chips as the US uses. Still, the government thinks the fabs could play a critical role in blunting the impact of a future crisis, like climate change or another pandemic. They also might help the US regain leadership in the industry it created and catch up to Taiwan, which makes almost all of the world’s most advanced chips today.

What’s unclear, however, is whether funding the construction of new fabs will be enough to make that happen. Building a single fab is a huge industrial project, so building several — quickly — will be a colossal undertaking. To an extent, the US is trying to domesticate technology that, for decades, has been produced by an international supply chain made up of thousands of companies, which means the success of these new fabs may still depend on other parts of the world. And even as the White House races to claim a bigger share of the world’s total chip manufacturing, other places, including Taiwan, are trying to do the same thing, which means there’s no guarantee the US will end up with the upper hand that it wants.

How America lost its homemade chips

Table of Contents

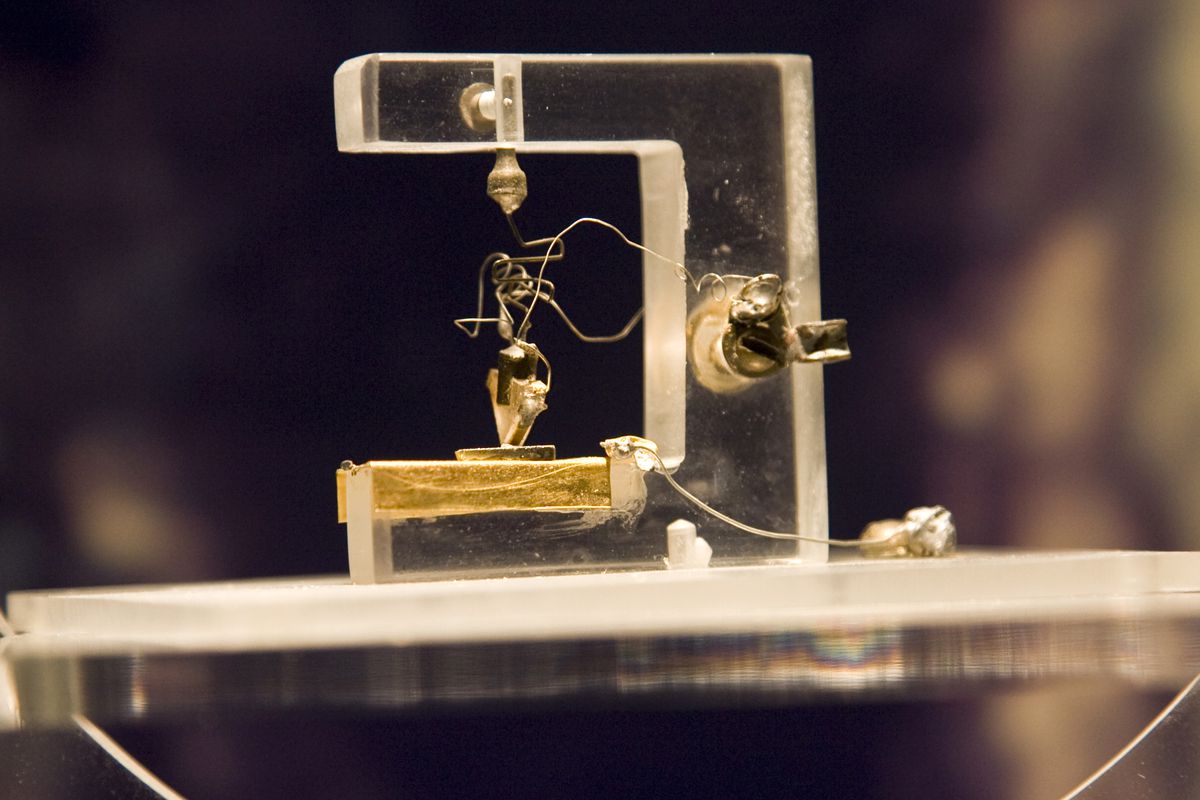

The US once dominated chip manufacturing. In 1947, scientists at Bell Labs created the world’s first transistor, a basic electronic switch, that can turn a signal on and off. This component became the foundation for the integrated circuit, also known as a computer chip, which packed multiple transistors into a single device. As the technology developed, new companies began competing not only to design chips with more transistors, but also to produce these chips at scale. High-tech manufacturing corridors emerged in Texas and what became Silicon Valley, paving the way for advanced consumer devices and appliances, often built with chips made in America.

The government played a pivotal role in making sure the US led the charge on this technology. The Defense Department was often the first customer for early semiconductor startups, and government officials sometimes required companies to share their designs so that other firms could use them, too. This support funded initial research that these chip companies otherwise couldn’t afford and laid the foundation for the tech industry we have today. The US used this funding strategy — sometimes called industrial policy — again in the late 1980s when it spent $900 million on a partnership called Sematech, in which American chip companies tried to ensure that they wouldn’t be overtaken by emerging competitors in Japan. For a time, the program succeeded.

But in recent decades, the US government has invested less and less in its homegrown chip industry, while other governments including Japan, Taiwan, South Korea, and, more recently, the European Union and China, have invested more. These massive subsidies — along with lower labor costs — have made it much cheaper for American companies to manufacture semiconductors abroad. Some even have taken a “fabless” approach, and focused their entire business on researching and designing chips rather than making them. As a result, just 12 percent of the world’s chip manufacturing takes place in the US today, compared to 37 percent in 1990.

This shift has benefited one company in particular: Taiwan Semiconductor Manufacturing Company, or TSMC, a Taiwanese chipmaker that manufactures chips on behalf of other firms. There’s a race to make smaller transistors — so more of them can fit onto a single chip — and TSMC is currently winning. Because of all of its manufacturing experience, TSMC now makes 92 percent of the most advanced semiconductors — that is, the chips that have transistors less than 10 nanometers wide — on the market today. None of these advanced chips are currently made in the US, which makes officials very worried.

“It’s a highly concentrated supply chain in certain parts of the world like Korea and Taiwan, and that has made our economy really vulnerable to disruptions because small events in countries can lead to large cost increases for American consumers and large shocks to US GDP,” Sameera Fazili, the deputy director of the Biden administration’s National Economic Council, told Recode. “They have the most advanced leading-edge chips, whereas we consume over 30 percent of those chips.”

This concern is based, in part, on fears that China may invade Taiwan at some point and attempt to take control of its chip-manufacturing capacity. But there are other reasons to be worried about the state of US semiconductors. The US doesn’t currently make very many of the most basic, or legacy, chips, which are typically produced where they can be made for less. These are the chips that became unavailable during the pandemic, and that made lots of technology hard to find and drove up car prices. The US will also need to manufacture more chips to maintain its hold on the auto industry, since EVs will likely need at least twice as many chips as their gas-powered counterparts do.

How to build a chip factory

To make its chips, Wolfspeed uses silicon carbide, a semiconducting material that’s especially useful for chips that power motors, like those in EVs. This silicon carbide comes in the form of translucent discs called wafers, which are delivered from another Wolfspeed plant in North Carolina. That facility has a special furnace that gets half as hot as the surface of the sun, which is needed to refine the material. Once these silicon carbide wafers are delivered to Wolfspeed’s facility in Marcy, they’re sent to a manufacturing floor, where a small army of robots slowly transforms them into sheets of chips.

Chipmaking is extremely delicate — the tiniest speck of dust or human hair can taint an entire batch — so Wolfspeed refines its wafers in a cleanroom, a highly monitored manufacturing floor with powerful air filtration systems. Inside this cleanroom, robots shuttle wafers between manufacturing steps while technicians monitor their activity from a nearby control room. This process includes lithography, when tiny patterns are printed into the wafer, and something called deposition, which involves adding layers of metals onto the silicon carbide. Once those steps are completed, the wafers are sent to another facility where they’re diced into individual chips. The entire operation is automated, and on the rare occasion that workers do need to enter the cleanroom, they have to wear astronaut-like protective gear, including a full bodysuit, a face shield, and boots.

Making chips is an intricate process, but building a factory that can do this type of manufacturing is even more complicated. For one thing, fabs can’t go just anywhere. They need to be close to a reliable source of electricity, since they can use as much energy as 50,000 homes in a single year (they release a lot of carbon emissions, too). These factories also need to be near a large body of water, which they use to clean and cool down their equipment, which, in turn, produces wastewater that needs to be treated. And it’s better if they’re not particularly close to any airports or geological fault lines; seismic activity can disrupt the incredibly precise machinery they use.

Then there’s the matter of the supply chain. Beyond the fab, making a chip can involve 70 different border crossings and more than 1,000 steps, and a single disruption in one country or during a particular step can throw the entire process off course. That’s because there are usually very few, if any, other options for supplies when something goes wrong. For example, just one company in the Netherlands, ASML, makes the specialized, $200 million lithography tools that many advanced chip fabs rely on. And just two firms, both based in Ukraine, supply about half of the specialized neon gas that fabs throughout the world use to control these lasers. Of course, securing all this equipment has gotten even more difficult during the pandemic.

“We couldn’t get this. We couldn’t get that,” John Palmour, Wolfspeed’s chief technology officer, told Recode. “It was just a constant supply chain scramble.”

All of this means the cost of building a fab can range from $1 billion to $20 billion, depending on the complexity of the chips that are being manufactured. This is the primary reason that the recent surge in demand for chips — fueled in part by the demand for more laptops and more cars — did not immediately result in more chip fabs. Because these plants take years to greenlight and construct, chip companies aren’t eager to spend billions on building more factories, since demand could always subside. This is partially why governments often intervene and provide incentives to build more chip factories.

Case in point: New York officials spent decades trying to attract a semiconductor company to Marcy, where New York state has funded a nanocenter associated with the SUNY Polytechnic Institute. Wolfspeed only agreed to take over the site after another company backed out and New York offered to subsidize the fab with a $500 million grant — about half of its total construction costs. Now, even more money is on the horizon, not just for another Wolfspeed factory, but for possibly even bigger fabs, including a new $100 billion megafab in Ohio built by Intel, which the administration is hoping will regain “the leading edge” and start building the same kind of advanced chips that TSMC makes. President Joe Biden, in his most recent State of the Union address, said that this facility, once it’s built, could provide as many as “10,000 new good-paying jobs.”

The big chip bet

Before any of that can happen, officials say the US needs to pass a $52 billion package called the Chips Act, which would subsidize the construction of several new fabs. Currently, the bill is packaged within a broader proposal called the United States Innovation and Competition Act, legislation focused on competitiveness with China. While the House and the Senate version of this plan aren’t exactly the same, the initiative has the support of Republicans, Democrats, the White House, and the major chip companies. The support from the industry isn’t surprising; each of these companies could theoretically receive up to $3 billion to build a new factory, and another $2 billion may be earmarked specifically to build a fab that would exclusively focus on more basic chips used in cars.

Proponents of the massive bill argue that it’s the bare minimum because other countries are still subsidizing chip manufacturing, too. Back in 2014, China launched a $150 billion effort to boost its own semiconductor industry over the next decade, and the country has imported fewer and fewer chips in recent years. South Korea plans to spend as much as $65 billion on its own national chip initiative. The European Union also has its own $49 billion Chips Act, and its member countries, including Spain and Germany, will soon launch their own incentive programs.

“The clock is ticking,” John Neuffer, the CEO of the Semiconductor Industry Association, a trade organization that represents American chip companies, told Recode. “Decisions are being made today as to where to site those fabs.”

Not everyone loves this approach; it’s effectively a corporate subsidy for companies that are already extremely profitable. Sen. Bernie Sanders has been highly critical of the Chips Act, and has said that chip companies should have to give up equity in exchange for massive grants. Others have argued that these companies would build new factories in the US regardless of federal incentives, since they also have reasons to steer clear of potential geopolitical conflict. And critics point out that chipmaking is not quite the jobs-creator that it’s sometimes advertised as, with most actual chip manufacturing being done via automation.

There’s no guarantee the funding will work. The US may not have enough of the specialized workers that chip manufacturing requires to support the number of fabs that officials want. Will Hunt, an analyst at Georgetown’s Center for Security and Emerging Technology (CSET), estimates that eight new fabs may require at least a few thousand foreign workers, since many of these facilities need to hire people with previous experience working in semiconductor manufacturing. Another concern is that the US’s lengthy regulatory and permitting process could slow down the construction of new factories, and the US already builds new fabs at a slower rate than countries in East Asia. Even after these facilities are constructed, they may not produce the number of chips or jobs that companies promise.

A senior economic official at the White House told Recode that while the $52 billion will boost American chip manufacturing, it won’t be enough to produce the number of chips the US consumes. Still, the government thinks that gaining this manufacturing expertise could be critical during a future emergency. After all, the pandemic has illustrated time and time again that when supplies are short, countries will try to secure the world’s most sought-after products — whether it’s chips, masks, or vaccines — and can even use them as a way to influence international relations. Governments would rather other governments be dependent on them than the other way around. In other words, they want bargaining chips.

So it’s not surprising that semiconductors have become that leverage. These tiny little chips are ubiquitous and have become a necessity in most people’s everyday lives. There’s no indication that’s changing anytime soon, especially since more powerful devices — which use even more powerful semiconductors — are always being rolled out. As long as the world depends on this technology, countries will want as much control over chips as they can get. That means that even with Wolfspeed’s factory now open for business, the US still has a long road ahead.

Correction, May 3, 9:30 am: Due to an editing error, an earlier version of this article said that Taiwan made most of the world’s chips. The country actually manufactures 92 percent of the world’s most advanced chips.