As a small business owner, there are bound to be situations, where you need quick capital. Have you considered availing a merchant cash advance (MCA) to meet your working capital needs and to sort out cash flow problems?

Here, in this guide, we show you how merchant cash advances work, the benefits, and who is it ideal for.

What Is Merchant Cash Advance, And How Does It Work?

Table of Contents

Technically speaking a merchant cash advance is not a regular business loan. Rather, it’s an advance sum that a lender offers you. When you avail a merchant cash advance, the lender gives you a one-time fixed sum, which you can use for any business needs. The sum you have borrowed is repaid as small daily amounts, deducted from the credit/debit card transactions carried out in your store.

The daily amount you repay is known as retrieval rate, and it can vary anywhere from five to twenty per cent of the daily credit/debit card swipes at your business. This rate depends on the amount you have borrowed, the daily credit/debit card sales at your store, and the repayment tenure.

Features Of A Merchant Cash Advance:

- Repayment begins as soon as you receive funds.

- The repayment tenure can range from 3 months to 12 months or more, depending on the lender’s terms and conditions.

- The sum you are eligible to borrow depends on your average credit/debit card sales for the last 3 to 6 months.

- A lender can advance you a sum ranging from 50% to 150% of your business credit/debit card sales.

Benefits Of Merchant Cash Advances

- A quick and hassle-free application process

- Immediate availability of funds

- No need to have high credit scores for eligibility

- No need for collateral

- Flexible repayment schedule

- Borrowing limit depends on your credit/debit card sales

Also Read: Top 5 Reasons Why Your Business Benefits From A Merchant Cash Advance

Now, coming to the big question,

Is A Merchant Cash Advance Suitable For You?

A merchant cash advance is an excellent way to overcome gaps in your cash flow and to boost your short-term working capital. However, it may not be the right solution for all. Here’s how to determine whether a merchant cash advance is the right choice for your business.

You can avail a merchant cash advance, if:

- You require capital fast

- You have large credit/debit cards sales

- Your business has fluctuating month-on-month sales/turnover

If you meet the above conditions, then a merchant cash advance may be the right loan product for you. However, it may not be the best choice for you, if:

- You want to build your credit score – Since a merchant cash advance is not technically a loan, it doesn’t contribute to building your credit score like a traditional business loan.

- Your business doesn’t have much of credit/debit card sales daily. Since the repayment is debited automatically of your credit/debit card sales, merchant cash advances are not the right choice for you if you have low volumes of credit/debit card sales.

Also Read: Top 7 Mistakes Retailers Make When Choosing A Pos (And, Ways To Avoid Them)

How To Apply For Merchant Cash Advances?

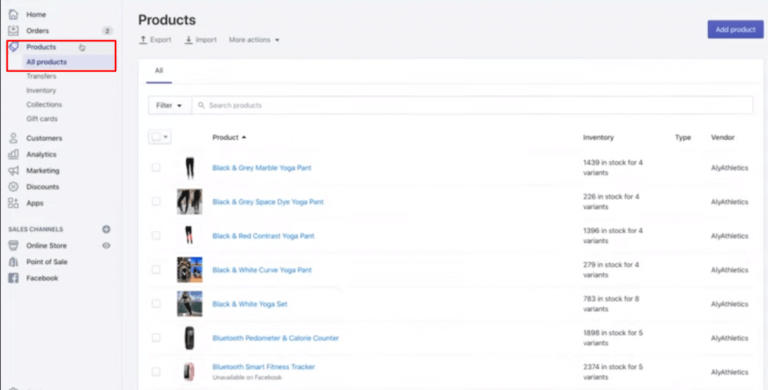

Not all lenders offer merchant cash advances. Online lending platforms like Indifi offer merchant cash advances to all merchants who meet the following three simple criteria:

- Minimum 2 years of business operational history

- Minimum six months card swipe history

- Minimum monthly card transactions of Rs. 50,000

Now, that you’ve understood the working and benefits of merchant cash advances; check out whether it’s the right choice for your business and boost your working capital, and make use of opportunities that come your way.