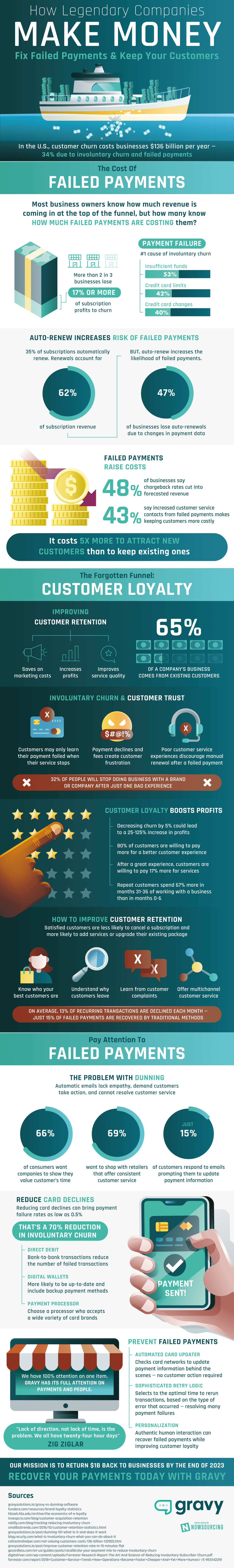

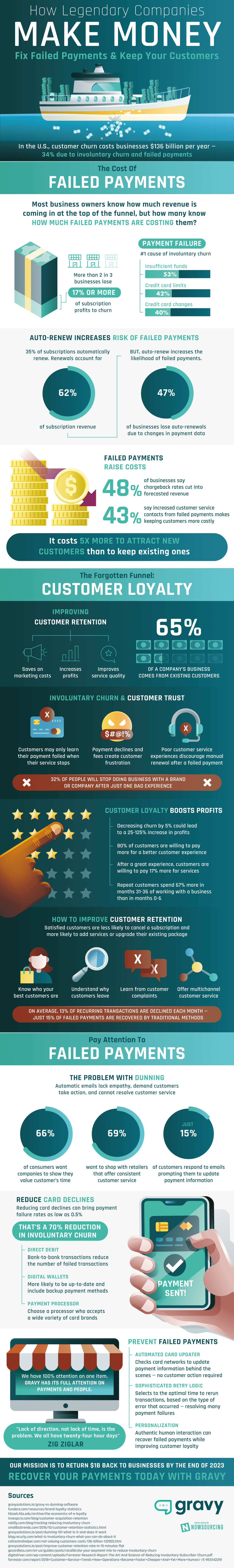

What Causes Failed Payments?

Formally known as churn, payment failure primarily stems from the attempting purchaser having insufficient funds, outdated credit card information, or exceeding their credit card limit. However, matters regarding churn can also stem from business technicalities, such as server errors: another instance in which payments may fail.

Regardless of the reason, failed payments can be catastrophic on both businesses and their consumers. Not only do businesses lose income from non-receival of payment, but customers may also lose access to services they love.

For example, customers may only learn their payment has failed once their service has been interrupted. With service interruption being a gateway to raising customer frustration, using strategic approaches (including customer retention tactics) when working to reduce churn rates may show healthy payoffs.

How Much Do Failed Payments Cost Businesses?

On average, American businesses lose $136 billion per year on customer churn costs. Furthermore, modern businesses who rely on auto-renewals earn 62% of their revenue from subscriptions. However, auto-renewals increase the likelihood of failed payments.

Not only do more than 2 in 3 businesses lose 17% or more of subscription profits to churn, but 47% of businesses also lose auto-renewals due to changes in payment data. For example, changed expiration dates, zip codes, and card numbers.

All in all, failed payments raise operational costs. How? 48% of businesses say chargeback rates cut into forecasted revenue. Similarly, 43% say increased customer service contacts from failed payments make keeping customers more costly. However, it costs 5x more to attract new customers than to keep existing ones.

The solution? Personability as means for retaining customer loyalty.

How Businesses Can Reduce Involuntary Churn:

First and foremost, improving customer retention is your easiest approach to saving money on marketing costs, increasing profits, and improving your brand’s quality of service. Take it from the experts – 65% of a company’s business comes from existing customers.

The commonality of customers not knowing their payment has failed until their service stops was previously mentioned. A great way to prevent the customer, and fiscal, frustration this can cause is to boost the amount of personability put into your customer loyalty tactics.

The old adage, “The customer’s always right” may still, to some extent, prove true. Statistically, 32% of people will stop doing business with a company after just one bad experience. Knowing this, you can improve your brand’s profits by improving your range of customer service.

Just as unfavorable service can turn customers away, respectable efforts can attract. After a great experience, customers are willing to pay 17% more for services. On top of that, repeat customers spend 67% more in months 31-36 of working with a business than in months 0-6.

Since satisfied customers are less likely to cancel a subscription and are more likely to add services or upgrade their existing packages, it will prove beneficial to know who your best customers are. Additionally, get to the bottom of why customers leave your business. This can be achieved by learning from customer complaints and offering multichannel customer service to broaden the available avenues consumers have to submit feedback.

Outside of improving your brand’s customer relations, turn to technology for a more hands-on approach to tackling your business’ amount of failed payments. For example, you can reduce card declines by using payment processors, digital wallets, and using direct debit transactions. Automatic card updaters are also a great tool for reducing involuntary churn as they check card networks to update payment information behind the scenes. This way, customers don’t have to manually update their card data for auto-renewing services.

E-commerce businesses can keep track of their churn rates by keeping tidy financial statements. For example, finding the exact amounts of revenue from each sales channel. On top of that, e-commerce businesses can opt for software rather than card reader-esque hardware. Specialty software can organize neat income statements, allowing business leaders access to their specific sources of revenue.

Research has pointed involuntary churn out to be the #1 cause of payment failure. In fact, 34% of failed payments are due to involuntary churn and failed payments. Zig Ziglar, an expert in personal development training, believes Lack of direction, not lack of time, is the problem.” Survivability is essential, and in the world of business, survivability does not come without consumers. Does your business model include tactics for improving customer retention or failed payment reduction?

Source: GravySolutions.io

Photo by CardMapr on Unsplash