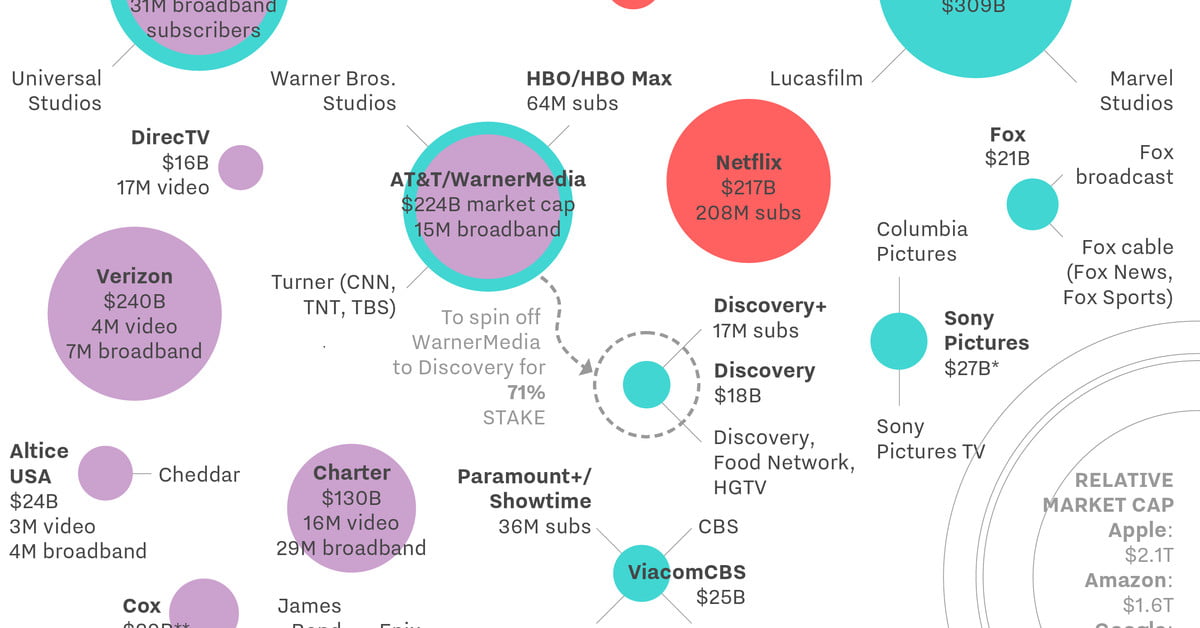

The media landscape used to be straightforward: Content companies (studios) made stuff (TV shows and movies) and sold it to pay TV distributors, who sold it to consumers.

Now things are up for grabs: Netflix buys stuff from the studios, but it’s making its own stuff, too, and it’s selling it directly to consumers. That’s one of the reasons older media companies are trying to compete by consolidating. Disney, for example, bought much of 21st Century Fox — though much of the early success of its Disney+ streaming service looks like it’s a result of earlier purchases of Lucasfilm, Marvel, and Pixar. Meanwhile distributors like AT&T, which bought Time Warner, and Verizon, which bought AOL and Yahoo, thought they wanted to become media companies — and have now done an about-face and are bailing out of those acquisitions.

Meanwhile, giant tech companies like Google, Amazon, and Apple that used to be on the sidelines are getting closer and closer to the action. Apple’s newest TV strategy positions the company as a TV guide, a TV storefront selling services like HBO, and a TV creator that employs the likes of Steven Spielberg and Jennifer Aniston to make exclusive shows for Apple users. So far, it doesn’t seem as if Apple’s lavish spending on original shows and movies has helped it build a real audience.

To help sort this all out, we’ve created a diagram that organizes distributors, content companies and internet video companies by market cap — the value investors assign to the companies — and their main lines of business.

Here’s what the Big Media universe currently looks like. We will update it periodically:

This article originally appeared on Recode.net.