Cash Management is the Solicited Rule of Business

Table of Contents

The power of cash flow in business describes what we do, how we do, and what needs to change for positive cash flow. When it comes to running a business, cash is the pivotal notch around which every transaction revolves. It is the king of any business – the lifeline which keeps the business flowing and growing.

Cash flow in simple terms means, the flow of cash coming in and going out in business. Cash management, however, means to create a balance between these two in such a way that positive cash flow is on the higher side. Regardless of the size, duration, and origin of the business, managing cash inflow and outflow is ought to be an integral part of the company.

Also Read: Cash Crunch: 7 Tips To Avoid It

Cash management can be a tough chore especially if you have just started. Therefore, here are some hacks for SMEs to keep their cash flow on the positive side of the balance sheet:

Analysis of cash flow

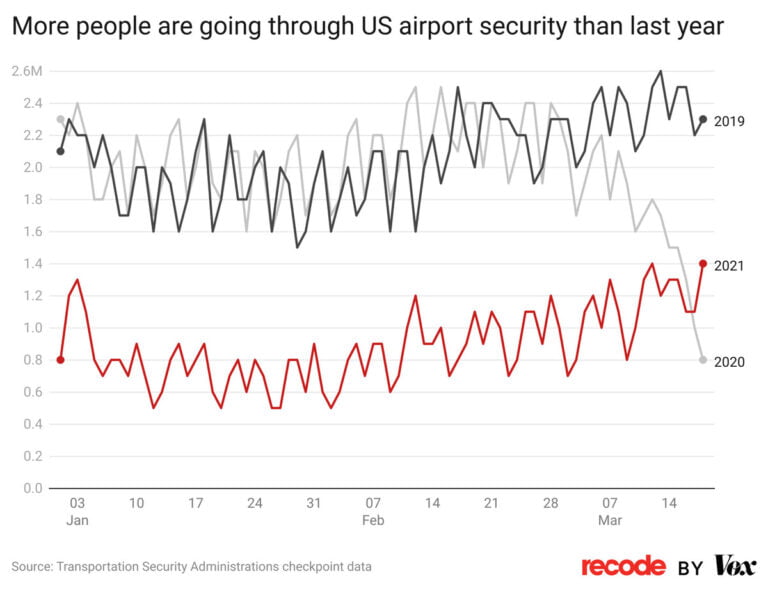

Examining the cash flow provides an insight related to how much money is the business getting in and how much cash is leaving the business in a month. Anticipating cash flow aids in cost-cutting whenever the business needs it and can provide you with the edge of enough cash whenever your business needs it.

Benefit

Keeping an eye on your monthly cash flow will help you prioritize tasks in business. Only when you know what you are left with, you can cut down on expenses that can wait.

Also Read: Change The Way You Think Of Debt

Maintain your business invoices

Going digital is an essential part of the business. Thus, it adds the leverage of time and energy when it is about maintaining the accounting records of business due to the availability of software nowadays. In earlier times, keeping a record of every business transaction was not that easy, mostly because it was all hand-written.

Benefit

Taking care of invoices in business aids in knowing the exact amount of cash inflow and outflow. Also, invoices give you the power of knowing who owes the business what and when are the dues payable?

Also Read: How To Immunize Yourself To Inflation

Derive a cash flow pattern

For SMEs, it is essential to derive their unique cash flow pattern. Businesses are different in many ways even when they belong to the same industry. This means, their working style, cash flow, and transaction pattern are also different. Knowing what your competitors are doing and are good at is fine, but following their cash flow pattern can be a bad move for your business.

Benefit: having a cash flow pattern prepares you for any unforeseen loss in the business. It also aids in examining accounting, sales, and revenue effortlessly. Like our daily lives, the patterns make it easier for us to do our daily jobs. Similarly, in business, you can focus on major decisions when daily transactions are already taken care of by the pattern.

Also Read: Debt Or Equity: Find Out What’s Best For Financing A Company

Equilibrium – payables and receivables

This element is neglected by most businesses to comprehend cost-cutting measurements. To maintain positive cash flow, money that comes in has to compensate for the money that goes out from the business in an equilibrium way. Ensure to keep the terms of payment with your customers the same that you keep with your suppliers.

Benefit: this bridges the gap between your payables and receivables. Imagine, giving your customer a month to clear all his dues when you have to pay your supplier within a fortnight. You surely cannot get away from this without paying a late fee penalty to your supplier.

Reduce cash outflow

This is the thumb rule of any business – whether you have taken a business loan or have financers investing in your business, cost-cutting is the only way to get the business going for long. The expenses that can wait should not be incurred when not needed. For instance, replacing a piece of machinery whose part is not working optimally is not the ultimate solution. Instead, you can fix the part of machinery that needs replacement.

Benefit: it gives you the added advantage of using this cash on an unavoidable transaction. Sometimes in business, certain transactions appear spontaneously. What will you do if your cash outflow is already keeping your business at the edge?

Also Read: Cash Flow Management Tips For Seasonal Businesses To Remain Profitable Year Around

To conclude

Your business cannot run out of cash else, you will run out of business soon. These five hacks will aid you in maintaining positive cash flow. For businesses that need loan assistance, for them, Indifi is the ultimate solution. It ensures to help businesses avail loans by reducing risk, minimizing paperwork, and providing a pleasurable experience. It is a market leader when it comes to backing up the business financially when other financial institutions fail to do it.