An e-way bill is a compliance system created by the Government of India to ensure that the goods transported across the country abide by the GST laws and further prevent tax evasion.

The Electronic Way Bill (E-Way Bill) is the digital portal that provides a seamless gateway to the concerned personnel for generating the bill before beginning the transportation.

E Way Bill mandatorily comes into play when a GST (Goods and Services Tax) registered entity wants to transport goods valued at more than ₹50,000. A unique E-Way Bill No. (EBN) is provided to the supplies, the recipient, and the transporter when an E Way Bill is generated successfully. This article discusses in detail the method to generate E Way Bills and the essential factors to keep in mind.

Also Read: How To Create a Balance Sheet for Your Business

An E-Way Bill has two sections:

- Part I: This section contains invoice details like GSTIN (supplier and recipient), invoice number, delivery address, HSN codes, and so on.

- Part II: This section contains information related to the transporter, such as transporter ID, vehicle number, and so on.

The portal has single and consolidated options under EWB-01 and EWB-02, depending on whether you aim to transport one consignment or multiple consignments, respectively, in single transportation. This will be a determinator for both supplier and/or recipient to calculate break-even point.

Please note that there are a few prerequisites for an e-Way Bill generation despite the method you use.

- Registration on EWB portal

- You must possess the consignment’s invoice or challan.

- Transporter ID or vehicle number for road transportations.

- Transporter ID, Transport Document number, and the date mentioned on the document for transportations via rail, airways, and/or ship.

Also Read: Role of Balance Sheets in Acquiring a Business Loan

The EWB-01 E Way Bill can be generated using any of the following methods:

- Web Portal [ https://ewaybill.nic.in/ ]

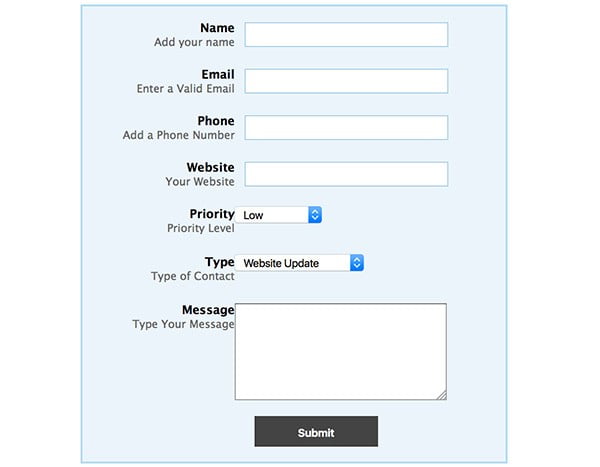

This is a four-step process.

- You need to log in to the portal system by providing the username and password you created while registering.

- Select the ‘Generate New’ option under the ‘e-Waybill’ drop-down menu, placed to the left side.

- This is the lengthiest step in this process. Kindly recheck all the details before proceeding further.

i) Transaction Type: Choose ‘Inward’ if you are the recipient of the goods.

The supplier of the consignment should choose ‘Outward’.

ii) Sub-type: You should select the appropriate sub-type from the options displayed depending on whether you chose ‘Inward’ or ‘Outward’.

iii) Document type: The listed options are

- Invoice.

- Bill.

- Challan.

- Credit Note.

- Bill of Entry.

- If not any of the listed, Choose ‘Others’.

iv) Enter the document or the invoice number.

v) Provide the date of the invoice or alternate document. The current date and the user should remember not to mention a future date which will be an invalid entry.

vi) Enter the supplier’s name, address, and GSTIN details and the recipient in the From and To section, respectively.

Also Read: All you need to know about business loans and taxes

Note: An unregistered supplier should mention ‘URP’ (Unregistered Person) in the GSTIN column.

vii) Enter the consignment information in this section under the appropriate field following the HSN Code.

- Description.

- HSN Code.

- Quantity.

- Unit.

- Value/taxable value.

- Tax rates of CGST and SGST or IGST (in %).

- Tax rate of Cess, if any charged (in %).

Note: After implementing the E-Way Bill, the corresponding entries of the details provided here can be auto-populated in the GST portal while filing the related GST return.

viii) Enter the mode of transportation and the estimated distance to be covered. While these details are mandatory, additional details can be filled in from the two options.

Transporter name, transporter ID, transporter Doc. No. & Date.

OR

The vehicle number of the vehicle used for transporting the consignment.

Note: For frequently used products, clients, suppliers, and transporters, kindly update the ‘My masters’ section first, available on the login dashboard.

Also Read: New Tax or Old Tax Regime – Which One Should You Pick?

4. Click on ‘Submit’. After validating data, the system either alerts of errors in the data (if any) or generates an e-way bill containing a unique 12-digit number for your EWB-01 form.

This concludes the process of generating an e-way bill on the website portal. You are also provided with the option to alter the vehicle number on an existing EWB and cancel a generated EWB.

Always print a hard copy and keep it in your possession. You can also print the e-way bill anytime using the ‘Print EWB’ option available under the ‘e-Waybill’ section.

The entity that aims to generate only a single bill and/or users who cannot access the web portal can utilise the SMS method. It is also an efficient method in urgent times and emergencies. To avail of this feature, you must register for the SMS facility at the online portal.

- Access the online portal and enter your login credentials. In the left section of the dashboard, select ‘Registration’ and choose the SMS option from the drop-down menu.

- Please note that you must have already registered your mobile number in the portal to utilise the SMS facility. Your registered mobile number is partially made visible. Click on ‘Send OTP’, type in the OTP you receive via SMS, and click on Verify.

You can only add up to two mobile numbers for one registered GST user. If the same mobile number is associated with multiple user IDs, select your mobile number used for more than one User ID created, then select the appropriate ID and press ‘Submit’.

You are now permitted to use the SMS facility. There are a set of pre-defined codes to be used mandatorily for successful use of the SMS facility.

Also Read: 9 Common Tax Mistakes You Should Never Make

- Through e-Invoicing

Existing users of the digital portal can use the same login details to access the e-Invoice portal. Using your unique IRN (Invoice Reference Number), you can generate an e-way bill on this portal. Additionally, there is an option of bulk e-way bill generation for businesses that execute many transactions each day. It is a relatively new method, and technical errors might occur.

- Begin by uploading the invoice details at the e-Invoice portal.

- After successful verification and validation of the details by the GSTN, you will be issued a unique IRN (Invoice Reference Number) and an additional QR code on the invoice. The data is then automatically transferred in the backend to the e-way bill portal, and the APIs are used to generate e-way bills from IRN.

- You can now log in to the e-way bill portal and enter the IRN to generate the bill.

Kindly check the E-Way Bill regularly to stay updated about any changes.

Also Read: Tax Saving – Best Practice For E-Commerce Sellers