The festive season is right around the corner. And for businesses, this busy period is not always easy. You need to handle your festive sales efficiently, by providing customers with the right service, stocking the latest trends, boosting your inventory and more.

However, all this is easier said than done. To do these, you need sufficient cash reserves, and as a small or medium sized business, we’re pretty sure that you’re running on an extremely tight working capital.

Here, in this post, we take a closer look at how boosting your working capital to prepare better for the festive season is a smart move for different industries.

Retail

Table of Contents

This is one business that generally peaks during the festive season. Whether you sell clothes, accessories, home décor, gadgets, groceries or any other consumer product, you need to have your inventory stocked to serve the influx of customers during the festive season.

Here are a few challenges to overcome during this period:

- Insufficient Inventory

- Lack of staff

- Low Marketing budget

E-commerce

If you’re an e-commerce store owner, then you need to put in extra efforts to make your brand stand out from tons of others, during the festive season. You need to build up your inventory to meet customer demands, prepare your servers and other backend software to handle unexpected traffic spikes during festive sales.

Also Read: Five Ways Working Capital Loans Can Work For Your Business

Here are the main factors you have to prep in anticipation of the festive season:

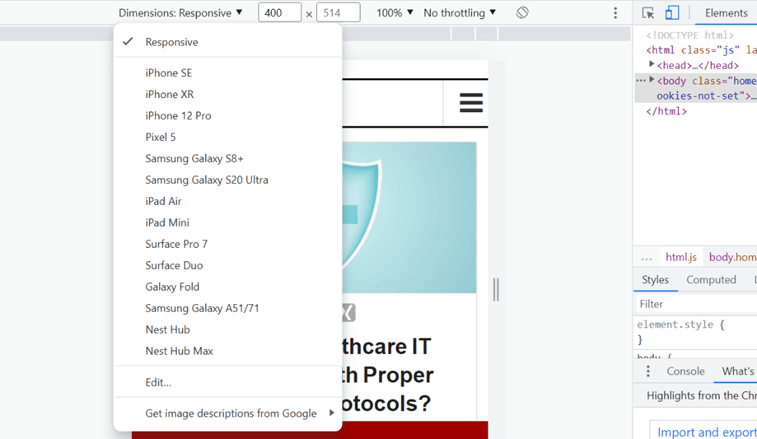

- Bandwidth and technology updates of your e-commerce store

- Inventory restocking to successfully meet customer shopping lists

- Digital marketing campaigns to improve the visibility of your store online

Wholesale

Unlike what most people assume, wholesale businesses don’t shut down during the festive season. Instead, the months before Diwali and other festivals are some of the busiest periods for wholesale businesses.

You’ll have to ship big orders to your regular clientele so that they can gear up for festival season. As a wholesale business owner, it’s essential that you fulfill these orders promptly.

Here are a few ways, by which Wholesale Businesses can benefit from Additional Working Capital:

- Equipment updates

- Improved logistics and other technologies

- Additional Inventory

Also Read: Merchant Capital – A Shot In The Arm To Small Businesses That Require Working Capital

Hospitality

The festive season is when people visit their extended families, friends or take a much-needed vacation. Hospitality businesses see maximum business during this period. To handle the extra consumer demand, you’ll have to add additional staff, update your technology, offer festive promotions and new services during this period.

Services And Agencies

Just like hospitality, businesses providing services like salons, spas, home cleaning and more, see a huge spike in demand during the festive season. You need additional working capital to provide customers with tempting offers and exciting new services this festive season.

Working Capital Is The Answer

In short, all businesses, irrespective of nature, size, and industry, need funds to manage these challenges and turn the festive season into an opportunity to boost profits. A working capital loan helps you overcome these challenges efficiently and gives you a winning edge over your competitors. Increased sales, improved customer service, customer trust, and loyalty are some of the benefits of availing working capital loans during this season.

Why Consider Digital Lending?

Dusshera, Durga Puja, Diwali — the festive season is quite busy. It’s the time of the year, when business owners are rushed off their feet, handling umpteen tasks. As a business owner, you don’t have the luxury of waiting for working capital during the busy festive season. You need access to funds immediately.

When you approach the traditional lenders, the loan process is quite drawn out, and it may take weeks (and even months) for the loan to get approved. The result — the festive season is over before you can get the funds to boost your working capital.

Apply For Working Capital Term Loan

On the other hand, digital lenders like Indifi, approve your financing in as little as 24 hours. And, the process is quite simple. Everything is done online — you submit your application, furnish the necessary documents, and the fund is sent to your business banking account, without any hassles.

So, what are you waiting for? Apply for a working capital loan this festive season, capitalize on new opportunities and let your business soar to new heights.