Implementing the best tax saving practice no matter whether it is business related to the travel agencies or any other business, not merely results in ensuring a hassle-free tax filing process year by year but it also enables business owners to enjoy greater funds liquidity. Here, take a glance at a few best tax-saving practices for travel agencies that can also be implemented by the other business owners:-

Best Tax Saving Practice For Travel Agencies

Table of Contents

- 1 Best Tax Saving Practice For Travel Agencies

- 1.1 Receipts Tracking In Accurate Manner

- 1.2 Deduct Tax At Source

- 1.3 Steer Clear Of Penalties Arising From Delayed Payments

- 1.4 Consider Short-term Business Tax Debt Loan

- 1.5 Invest In Advanced Tax Filing Software

- 1.6 Consider Obtaining Relevant Tax Deduction

- 1.7 Mutual Fund SIP Treatment

- 1.8 Business Restructuring

Receipts Tracking In Accurate Manner

To maximize deductions, it is essential to be aware of the expenditure that takes place in the entire year. Especially, in the context of an audit, these receipts serve as proof related to the expenditures that further validate the stated log deductions. Therefore, the first and foremost best tax saving practice for travel agencies begins from the foolproof commitment towards tracking receipts accurately.

Also Read: Why Income Tax Return Filing Is Important

Deduct Tax At Source

Failing to deduct tax at source may ultimately lead to an increase in the tax burden. There are various transactions mentioned under the IT Act that requires the buyer or the receiver of the service to deduct tax at source when paying the seller or the provider of the service.

Steer Clear Of Penalties Arising From Delayed Payments

Despite possessing crystal clear clarity about the fact that late payments lead to penalties, many travel agency owners and also diversified business owners fail to do the needful on time. There are myriad ways to avoid late payments. Out of them, the simplest one is to get all the required documentation together during the initial months of the year. This leads to avoidance of faulty tax-filing at the last moment. Moreover, business owners also get sufficient time to plan for any unforeseen expenditure.

Also Read: Top 5 Strategies To Save Tax At The Last Minute

Consider Short-term Business Tax Debt Loan

One of the best yet most underrated tax-saving practices for travel agencies is to consider raising short-term working capital through seeking loans meant to ease business tax debt. It will not merely facilitate in covering tax-related payments but will also enable them to avoid any possibility related to late fees.

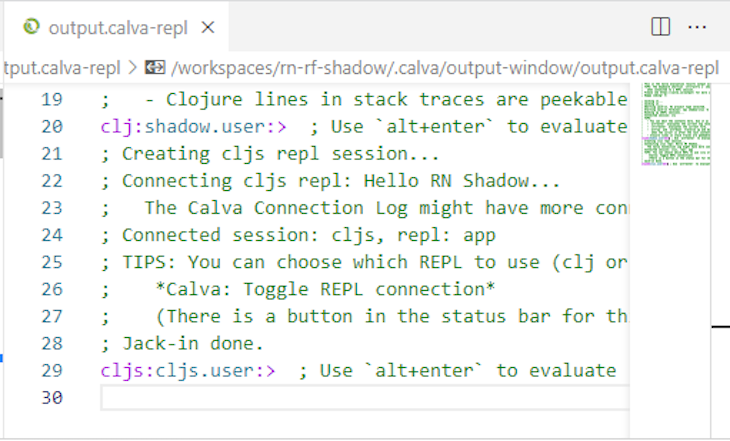

Invest In Advanced Tax Filing Software

Tax-filing has become easier owing to the availability of the range of advanced tax filing software. Investing in such software is bound to provide a return in the long run. With the help of such software, it becomes easier to get rid of errors in tax-filing. This in return, ends up inaccurate tax filing by nullifying any possibility related to the penalties.

Also Read: 9 Common Tax Mistakes You Should Never Make

Consider Obtaining Relevant Tax Deduction

Obtaining tax deduction on the tax return to provide benefits to the employees of a company, is also a brilliant tax-saving practice for travel agencies. With the help of a knowledge-oriented and expert tax professional, the understanding related to the diversified kinds of benefits that can impact tax can be easily gained.

Mutual Fund SIP Treatment

Selling units related to the mutual fund either on a FIFO basis or in installments is yet another noteworthy tax-saving practice for travel agencies. Doing so results in keeping unnecessary tax related to short-term capital gains away. In simple words, the first installment is considered to be the long term one and the remaining 11 installments will attract capital gain of short-term nature.

Also Read: Data Beyond Tax Returns: Time To Use Aggregator Platforms To Estimate SME’s Strength

Business Restructuring

This specific best tax saving practice for travel agencies is extremely effective if implemented correctly. However, in the absence of appropriate guidance from an expert, the majority of the travel agency owners fail to make use of this remarkable option. Due to the alteration in the tax policies, it is recommended to examine the effectiveness of the existing business structure from time to time. It is crucial to ensure that the existing business structure is serving the desired financial goals. If not, it is time to avoid resisting change by considering business restructuring.

Also Read: Best Tax Saving Practice For Restaurants

Final Thoughts

In a nutshell, pursuing the above tips can facilitate travel agency business owners to maximize their investments by keeping the unnecessary taxes at bay. Also, despite hiring an expert, it is recommended to possess at least fundamental knowledge related to the tax slab concepts, income tax rates, and implication expected to be generated out of any new law that is going to be introduced. By having clarity regarding the basic knowledge related to the tax matters, a business owner can be ensured that the hired professional is working appropriately.

Apply Finance For Travel Agencies

At Indifi, we understand that the needs of every business are different. As a result, we offer custom loan solutions for all types of businesses we serve. As a travel agency owner, you might need funds to offer an online booking facility, pay your employees, manage bulk bookings, offer credit to your corporate clients, or just working capital- we can help you get the best loan with the most flexible loan terms and repayment schedule. This lets you grow your business just the way you want it to.