Mobile payment platforms such as this appeal particularly to small and medium scale businesses, primarily for financial reasons. These enterprises of the country have the potential of contributing significantly to the country’s GDP but fall short due to various financial challenges, lack of infrastructure for marketing and access to low scale technology.

Signing up for platforms that enable cashless transactions can be of significant advantage to such businesses. It is convenient to use and easily accessible which makes it a popular choice for both customers and businesses.

Also Read: Surge Ahead: Boost Your PayTm Visibility With This 5 Proven Steps

Cash Transactions incur Greater Operational Costs

Table of Contents

While the idea may seem insignificant, businesses both small and big actually incur costs for carrying out transactions in cash. Whether it is for the cost of storing it or keeping people engaged in processing financial transactions with the banks – they take up time and money. The introduction of credit and debit card transactions have made many of these processes faster and easier but also incur additional charges of its own. There are processing charges levied by the banks to merchants. It also involves an infrastructure cost that can otherwise be avoided by being on PayTM.

PayTM is Low-Cost Setup and Convenient to Use

Mobile payment systems like PayTM mitigate many of the above mentioned operational costs. Setting up a PayTM account for businesses is as easy as for customers. There are a minimum cost and documentation involved in the process of signing up, it is fast and there is no requirement of any hardware setup either.

Also Read: How To Successfully Sell On PayTm?

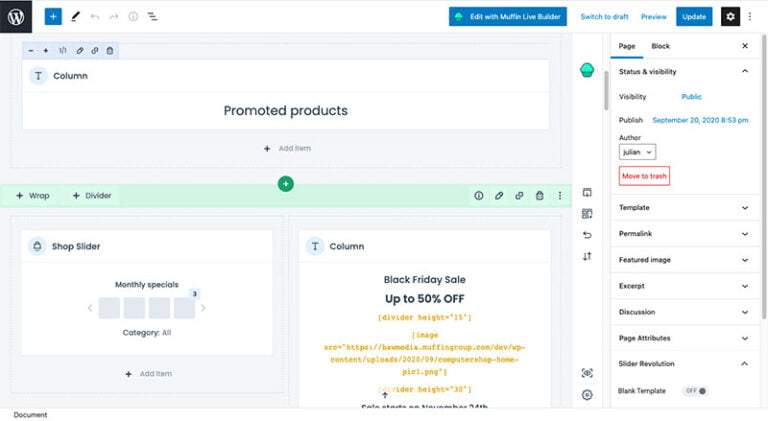

Even for businesses that want to set up websites, having customized designs to integrate digital/electronic payments can be complex. No cost or very low-cost setups such as payment gateways, wallets, subscriptions, and all such solutions are easily made available via PayTM.

Faster Transactions with No Additional Cost

Cashless payments are easier for the consumer and secured by a common UPI Pin. Bank holidays and weekends are no longer a restriction for making any kind of payments. Most modern customers prefer electronic payments because it is convenient.

Also Read: How To Successfully Sell Through Yatra?

The Option of Multiple Payment Methods

Customers want to have the option of multiple payment options for their purchases. Businesses, small or big must be able to offer customers that choice when it comes to making payments. A customer experience that is hassle-free, convenient and fast is beneficial for both parties. While payment optimization is a relevant area to focus on, PayTM’s digitized solutions are hassle-free. They don’t have to incur costs of processing and reduces the possibility of fraud.

For Merchants without Bank Accounts

Many small business setups are done by merchants who don’t even have a bank account. PayTM Wallet system enables many merchants to get started and conduct transactions with ease even in the absence of an account. The PayTM wallet feature comes in handy which would enable them to receive money as well as spend it later for their personal use as customers.

Also Read: How To Successfully Sell On Swiggy?

Keeping a Record of Financial Data

The operational costs of the administrative aspect of finances in a business can also be significant. It can be considerably reduced with the use of digital platforms like PayTM. Labor costs can be saved by having fewer people work on handling expenses while a record can be easily maintained by tracking transactions over a digital medium.

On a long term basis, analyses of transaction data accumulated over a period of time can provide insight into how consumers buy products and thereby tailor marketing strategies for businesses accordingly. This can be done without having the need to spend on additional procurement of consumer transaction data.

Also Read: How To Successfully Sell On Petpooja?

Reducing Operational Costs through Alternative Money Lending Sources

With no collateral, minimum documentation, and availability of several top lenders, Indifi makes the whole process of acquiring a loan simple and quick. With a single online application form, you can apply for a loan from multiple lenders in the least possible time. As the loan is customized as per the needs of online sellers, rest assured that it would perfectly suit the dynamic needs of your business.

Apply For E Commerce Loan India