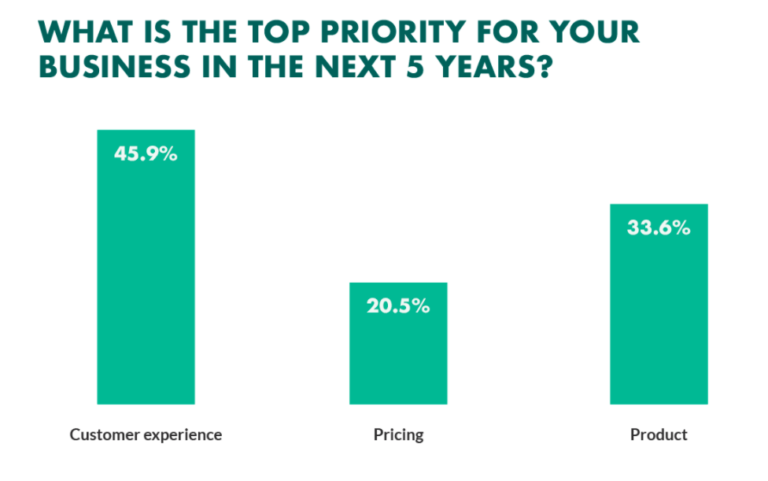

Climate change has become one of the world’s most pressing issues. With so many governments committed to achieving net zero emissions by 2050, it is no surprise that Environmental, Social and Governance (ESG) has shot up the corporate agenda. Investors and regulators are now demanding firm ESG commitments from fintech companies and consumers are increasingly choosing businesses that share their environmental outlook.

This trend is reflected in the markets. Today, ESG investments account for $20 trillion in assets under management or almost one-quarter of all professionally managed assets worldwide. And in the US, ESG-focused funds — worth in excess of $51.1bn — have grown tenfold over the last decade.

So how is ESG shaping the financial services industry and what can fintech companies do about it?

Shifting consumer perspectives

First of all, consumer behavior is having a significant impact on the industry. Nine out of 10 customers say that they want their banks to offer eco-friendly payments. While crypto transactions currently account for a tiny fraction of digital payments, they have a disproportionate effect on energy usage. According to one estimate, a single crypto transaction uses as much energy as ten US households do in a day. With publicity like this, it’s no wonder the payments industry is under increased pressure to improve its environmental record.

Two ways to reduce carbon emissions

There are several ways financial service firms can address this challenge. One is to take the approach of Nordic payment service provider TietoEVRY. It is using 100 different renewable energy sources to process card transactions at its data center. The company claims to have already reduced its environmental footprint by 56% since 2016 by taking this approach.

An alternative strategy is to shift responsibility back to the consumer. For example, Swedish-based FinTech Doconomy has developed a service, the Åland Index, which analyzes transactions and produces a dashboard showing a user’s carbon footprint. Users that sign up for the service can view the carbon footprint of purchases per month or category via a dedicated app.

The rise of ESG regulation

Consumers are not the only players nudging institutions toward a more carbon-friendly future. Regulators are also having an impact. At present, businesses must choose from a variety of established ESG frameworks including the Global Reporting Initiative (GRI), the EU Taxonomy, the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

More regulations are on the way. Mandatory and standardized ESG reporting is set to grow when the European Union (EU) rolls out its European Sustainability Standards and the UK introduces Sustainability Disclosure Requirements. Plans are also in place to create the first net zero-aligned financial center in the UK. If the proposal goes ahead, UK financial institutions will need to publish net zero transition plans detailing how they plan to decarbonize their businesses.

Readying the enterprise for change

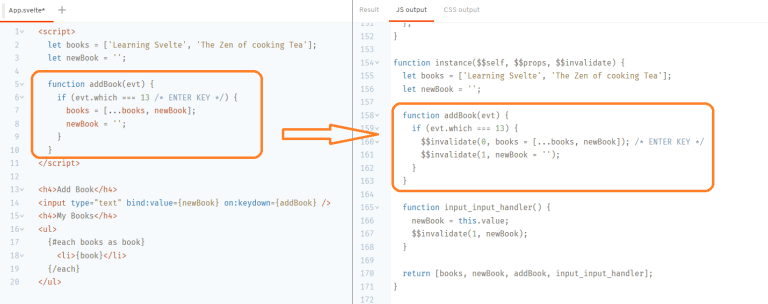

To avoid any surprises on the regulatory front, fintech companies should make sure that their data architecture is modular and flexible. They should revamp in-house analytical and reporting tools and look into updating their manual data-gathering processes. And they should partner with fintech consulting service providers to build bulletproof data governance frameworks.

Pressure to tackle environmental issues is likely to grow over the coming years as investors, consumers and governments focus on achieving net zero. That’s why it makes sense to tackle the issue with a fintech consulting partner. This is where Star’s team of digital finance experts can help you. As you set about responding to the challenges posed by ESG, Star can ensure that you have the right reporting infrastructure in place.